Now we’re getting into the important parts! When you submit your taxes, you will not submit one lump sum of all of your expenses for the year. This means I should set aside $106.80 to pay towards taxes.

This spreadsheet is set for 30% taxes.Īs you can see from the example in my spreadsheet, I earned $385 in January but was only paid $356. This is not something I am going to explain here since it varies so much for each person. However, some people keep out as much as 50% and pay quarterly. I personally keep out 25% because my husband has a full-time job.

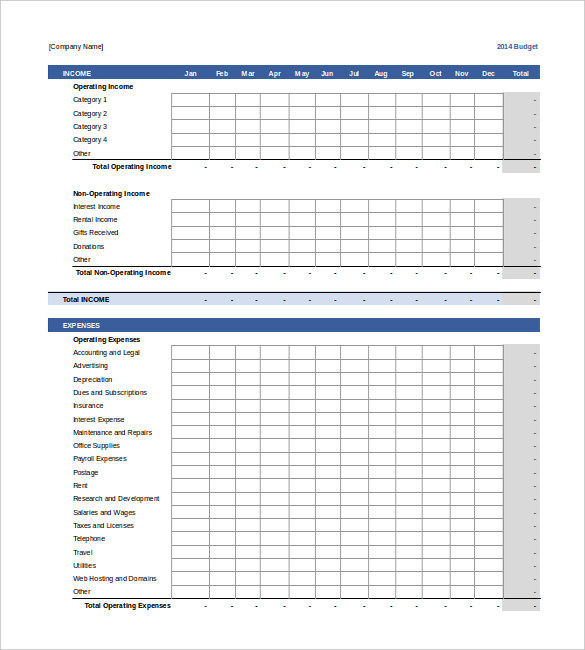

Hence the need for two lines per source.Įach state has radically different tax rates. Your taxes will be based on how much you have been paid, not how much you have earned. Anything I earned from Feedblitz (ad revenue from my emails) or Monumetric (ads on my website) get paid about a month later. For example, anything I earned from Amazon gets paid two months later. Unless the source is direct sales to me, it typically gets paid out a month or two after the month it was actually earned. One reason I keep track of my earnings in this same spreadsheet is so that I can calculate how much I should take out each month for taxes.Įach source of income has two lines: how much was earned that month, and how much was actually paid to me that month. The yearly total will help me at the end of the year see the difference between how much I actually spent in the year and how much I spend with irregular costs. The monthly total tells me that I need to be setting aside $95.67 for regular expenses. I like to have both the monthly and yearly totals. I put in Feedblitz monthly cost and multiplied it by 12 so that I can see how much it costs me each year. As you can see, I put in yearly amounts for GoDaddy, CoSchedule, and Tailwind, and divided them by 12. This first sheet tells me how much money I need to be setting aside for my regular expenses. In order to save up for that, I like to put a little bit of money aside each month. Sometimes these yearly fees can cost a few hundred dollars each. My email service, Feedblitz, is paid monthly. I also pay a yearly fee for my social media hosting through CoSchedule and my Pinterest/Instagram posting through Tailwind. For example, every year I pay a renewal fee for my blog’s hosting services from GoDaddy. Before we start actually categorizing expenses, I also like to have an idea of what my regular expenses are for budgeting purposes.

0 kommentar(er)

0 kommentar(er)